The U.S. labor market strengthened in the weeks before Election Day, as job growth accelerated in September and the unemployment rate ticked lower.

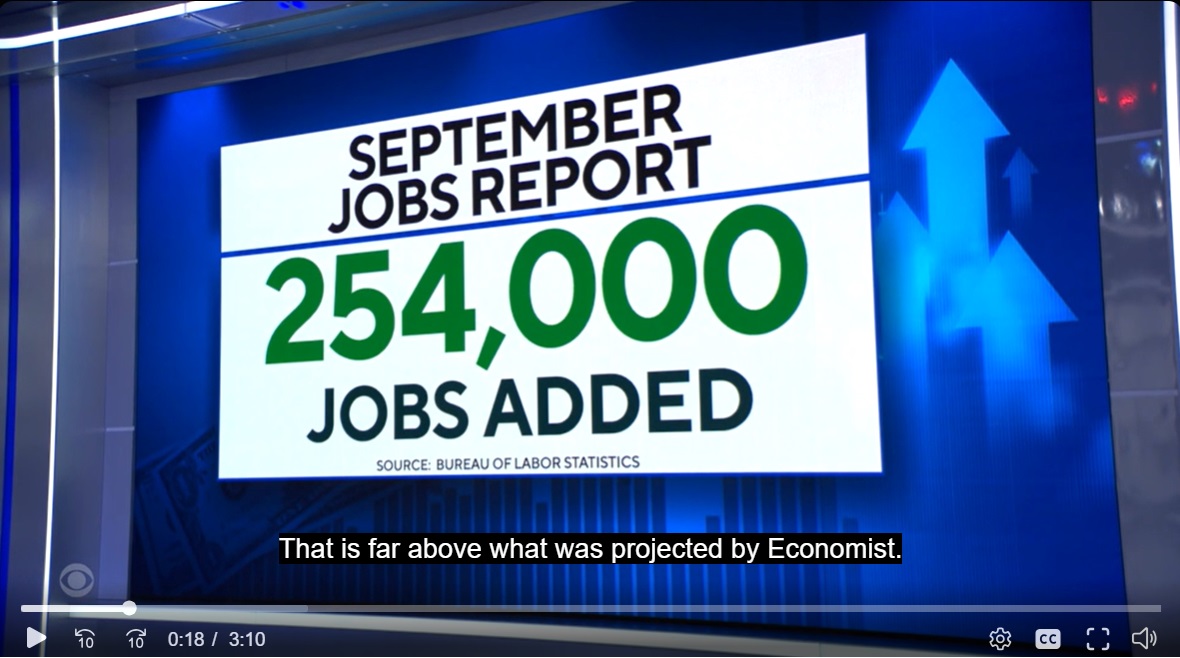

Employers added 254,000 jobs last month, the Labor Department said Friday. That was significantly more than the 150,000 economists expected, and marked the largest monthly increase since March. The unemployment rate slipped to 4.1%.

Friday’s bumper payrolls report is likely to close the door on another half-percentage-point rate cut by the Federal Reserve at its next meeting in November. It should keep officials on track to lower rates by a quarter point.

The Fed is trying to engineer what is called a soft landing, in which inflation moves down without major deterioration in the labor market. Though Friday is just one data point, it suggests that the U.S. is headed in that direction.

“It puts another set of wheels under the plane in terms of assuring a soft landing,” said Gregory Daco, chief economist at EY-Parthenon.

Friday’s report also signaled that hiring this summer wasn’t as weak as initially thought. Revised figures show employers added 72,000 more jobs in July and August combined than earlier reported.

The latest snapshot of the labor market’s health comes just a month before the U.S. presidential election, where the economy and inflation are key issues for voters. The strong jobs report could help Vice President Kamala Harris. In polls, she trails former President Donald Trump on the economy.

Stocks ticked higher. The Dow Jones Industrial Average rose 0.8%, or about 340 points, to 42,352.75, a record.

During much of the inflationary post-Covid-19 boom, stocks often quaked temporarily at stronger-than-expected economic data, because traders took such shocks as a sign that the Fed would tighten monetary policy more aggressively. Investors’ positive reaction Friday showed that they view good news as good news again—even if futures contracts tied to the federal-funds rate suggest traders are now expecting a slower pace of Fed easing.

Employers added jobs at bars and restaurants and construction, as well as in sectors that are less sensitive to the economy’s ups and downs like government, education and healthcare.

There were a few weak spots. Employers modestly cut head count in manufacturing, transportation and warehousing, and temporary help services.

Analysts also said that although September’s jobs report was unexpectedly strong, other economic data point to a slightly less robust hiring picture. Labor Department data released earlier this week showed that the share of workers quitting their jobs each month fell to its lowest rate in more than four years in August, a sign people are more hesitant about leaving their current roles for new ones.

Wages picked up slightly last month, according to the Labor Department. Average hourly earnings rose 4% from a year earlier, the strongest increase since May. That was well above the pace of inflation, which is positive news for price-pinched consumers. The consumer-price index was up 2.5% in August from a year earlier.

“There’s reason for caution, but also the resilience of the U.S. just continues to confound expectations,” said James Knightley, chief international economist at ING. “For that to continue, it needs the Fed to continue gradually easing policy just to give the economy a little bit more breathing room to continue growing.”

Inflationary pressures have eased markedly over the past two years, and the Fed’s focus has shifted more to hiring than price increases. That means the jobs market will play an outsize role in Fed officials’ decisions on the path of interest rates.

Conventional wisdom holds that cooling inflation comes hand-in-hand with a sharp slowdown in the labor market. However, over the past couple of years, U.S. employers have muscled through high interest rates with continued hiring, and inflation has fallen significantly. That combination, if sustained, would amount to a big win for the Fed.

“Perhaps we should reassess our analytical framework of soft landing versus hard landing and just call it what it is: a robust economic expansion,” said RSM U.S. chief economist Joe Brusuelas, in response to Friday’s payrolls report.

Fed Chair Jerome Powell said earlier this week that officials would continue to reduce interest rates from a two-decade high to maintain solid economic growth, but that they didn’t see a reason to lower rates as aggressively as they did at their most recent meeting.

The Fed’s next policy meeting is Nov. 6-7. Officials will see one more employment report before then, for October. That report, which will be released Nov. 1, could be less rosy. The month has already seen a major strike by dockworkers at dozens of U.S. ports, which ended late Thursday, and a continuing strike at Boeing. Hurricane Helene could also muddy the October jobs numbers.